Spring Budget 2024: Key points for business owners

The spring budget presents opportunities for small business owners, including cuts to National Insurance, VAT registration amounts

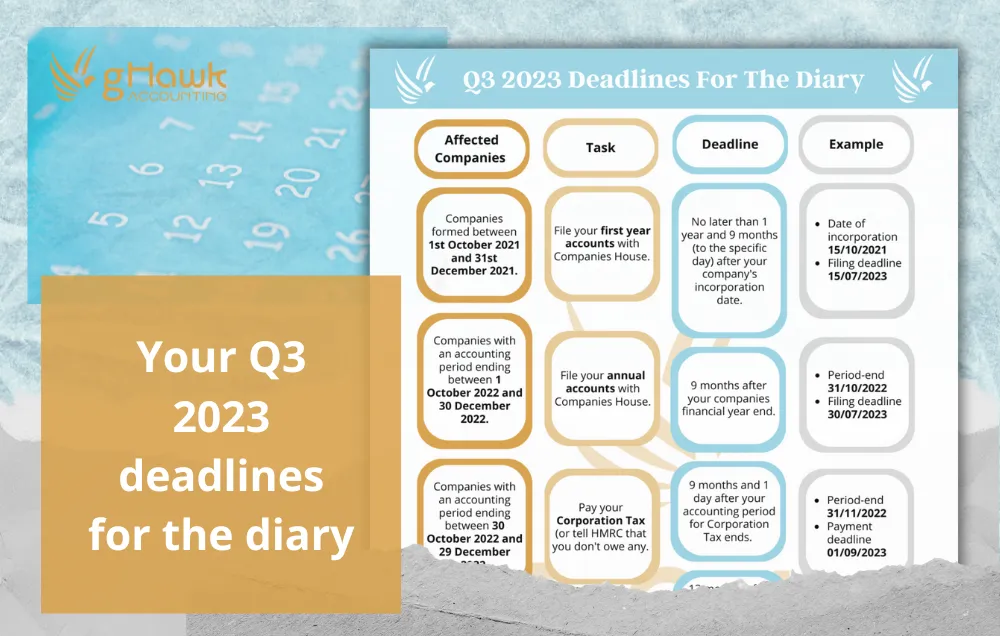

Your Q3 2023 deadlines for the diary

Here are the forthcoming deadlines and cut-off points for Q3 of 2023 to add to your diary.

When should I register my company for VAT?

Wondering if your business should be registered for VAT? We’ve got the lowdown on when (and how) to get VAT registered, and the key reasons for doing so.

What are the main changes to the research and development tax relief scheme?

Spring Budget 2023 brought in some significant changes to the Research and Development (R&D) tax relief scheme. Here’s our update on the big changes to be aware of.

HMRC Changes to VAT Online Account & Self Assessment Threshold Adjustment

HMRC has recently made significant changes to its VAT online account system, which affects VAT-registered businesses in the UK.

Taxpayers given more time for voluntary National Insurance Contributions

The UK government has extended the deadline for voluntary National Insurance contributions to 31 July 2023. Act soon to avoid missing out on this opportunity.

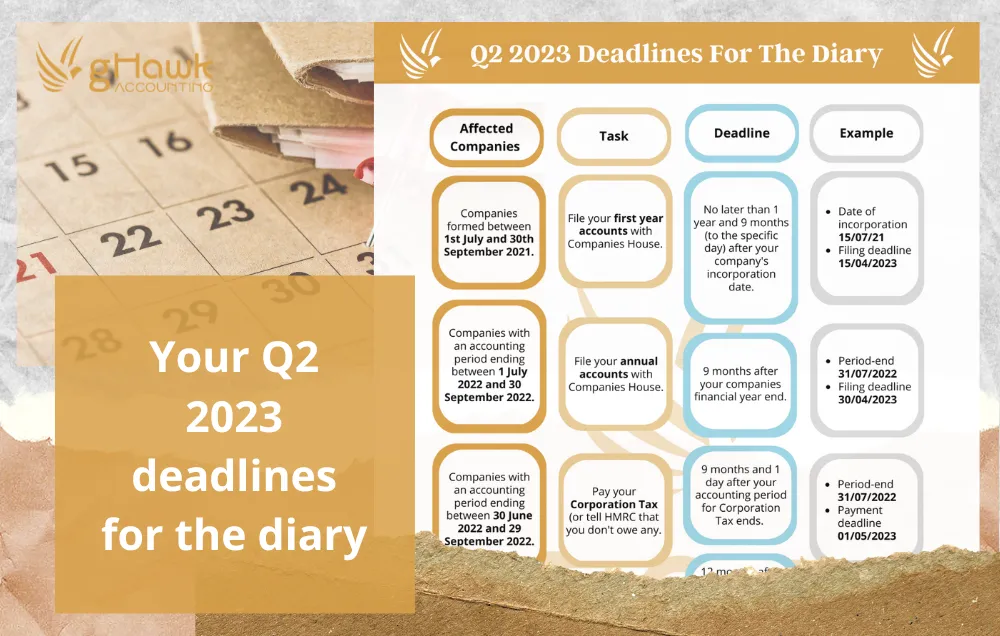

Your Q2 2023 deadlines for the diary

Get these Q2 2023 dates and deadlines in your diary – and make sure you don’t miss any important filing and tax cut-off dates.

QuickBooks Connect London 2023

gHawk Accounting attended QuickBooks Connect London to connect with strategic partners in the accounting industry and pick up on best practice for small business owners.

What is Section 455 Tax?

Do you have advances that have been paid to you? Under certain circumstances, these could trigger Section 455 tax. We explain the main rules and considerations.

Corporation Tax Rise from 19% to 25% from April 2023

From 1 April 2023, the rate of corporation tax will change from 19% to a variable rate between 19% to 25%, depending on the profits made by your business.

HMRC’s new penalty regime starts in January 2023

HM Revenue & Customs (HMRC) is about to update and change its penalty regime – and these new penalties could affect your tax submissions as early as January 2023.

Keeping your cashflow strong in tough times

When sales are slow, there are still overheads and salaries that need to be sorted. Pre-planning and being proactive can help you weather tighter economic periods and allow you to continue to thrive.

How to pay your Self-Assessment Income Tax

Taxes don’t have to be difficult or confusing. If you’re a freelancer or sole trader, it can be much easier to keep on top of your tax contributions than you might think.

Managing your business expenses automatically

automate the process of entering your bills, receipts and expenses by using AutoEntry. AutoEntry helps to save time by eliminating the manual entering of expenses.

Self-Assessment penalties to watch out for!

The deadline for filing a self-assessment tax return is 31 January. If you don’t submit your tax return, submit it late or submit incorrect information – you could face fines and penalties from HMRC.