Optimum salary for company directors in 2020-2021

At gHawk Accounting we believe the business is there to serve the owners, and not the other way round. One of the advantages of being a business owner is that you can set your own pay package at a level that meets your lifestyle needs and keeps tax to a minimum. In this article, we will cover the optimum options for paying yourself with a combination of salary and dividends while maximising on your untaxed allowances.

What are dividends?

‘Dividends’ is the name given to money paid out to investors who own shares in a company. These investors are called Shareholders. Dividends are the distribution of a company’s residual profits after tax. As a shareholder, you may take dividends as a form of remuneration. Dividends are taxed differently to your salary.

New tax rates:

Every tax year the government announces the tax rates for the financial year. It is important to know the prevailing tax rates when deciding how to pay yourself and how much to pay yourself as this will have an impact on how much tax you pay. This is called tax planning. For directors who are also shareholders, the best strategy is usually a combination of a salary and dividends.

For 2020-21, personal allowance (tax free earnings) remains £12,500 same as 2019-2020.

The tax rates for 2020-21 are as follows:

- £12,501 to £50,000 20%

- £50,000 to £150,000 40%

- £150,001 + 45%

Dividend allowance remains at £2,000 and any dividends in excess of that will be taxed as follows:

- You won’t pay tax if your unused personal allowance covers the additional dividend taken

- Dividends in the basic rate tax band will be taxed at 7.5%

- Dividends in excess of basic rate tax band will be taxed at 32.5%

- Dividends within the additional rate band (income over £150,000), will be taxed at 38.1%

Most company directors will opt to pay themselves enough of a salary to satisfy their National Insurance stamp in order to protect future entitlement to state pension. Additional funds are then taken as dividends for maximum tax efficiency. When paying corporation tax, your company will save 19% on any salary taken. The director then takes dividends, which do not technically save on corporation tax, as they are declared after tax – but they do save on National Insurance as dividends are NI exempt.

Employment Allowance

Employers can claim are able to claim the Employment Allowance (EA) in order to reduce their employer Class 1 National Insurance contributions. The rules regarding which businesses qualify for the EA changed from April 2020.

To be eligible for Employment allowance:

- the company must have more than one employee on payroll who is not a director

- and the employers’ Class 1 National Insurance liabilities were less than £100,000 in the previous tax year.

- If part of a group or have multiple PAYE Scheme, the total employers’ Class 1 National Insurance liabilities for the company or group of companies must be less than £100,000

- If receiving state aid, the Employment Allowance claimed must not exceed the de minimis state aid threshold for your sector

Optimum Directors Salary 2020-21 – Option 1

When it comes to tax efficient salary levels for 2020-21 there are now three national insurance thresholds you need to be aware of

- Lower Earnings Limit – if you pay a salary above this you are protecting your entitlement to future state pension and benefits, without paying any national insurance. For 2020-21 this is £520 per month, £6,240 for the year

- Primary Threshold – if you earn above this you personally must start paying national insurance – for 2020-21 this is £792 per month, £9,500 for the year

- Secondary Threshold – if you earn above this your business must start paying national insurance – for 2020-21 this is £732 per month, £8,788 for the year

A major change for the 2020-21 tax year is that the Secondary Threshold is lower than the Primary Threshold – this means that the optimum level for the purposes of this article is to go up to the Secondary Threshold but not any higher.

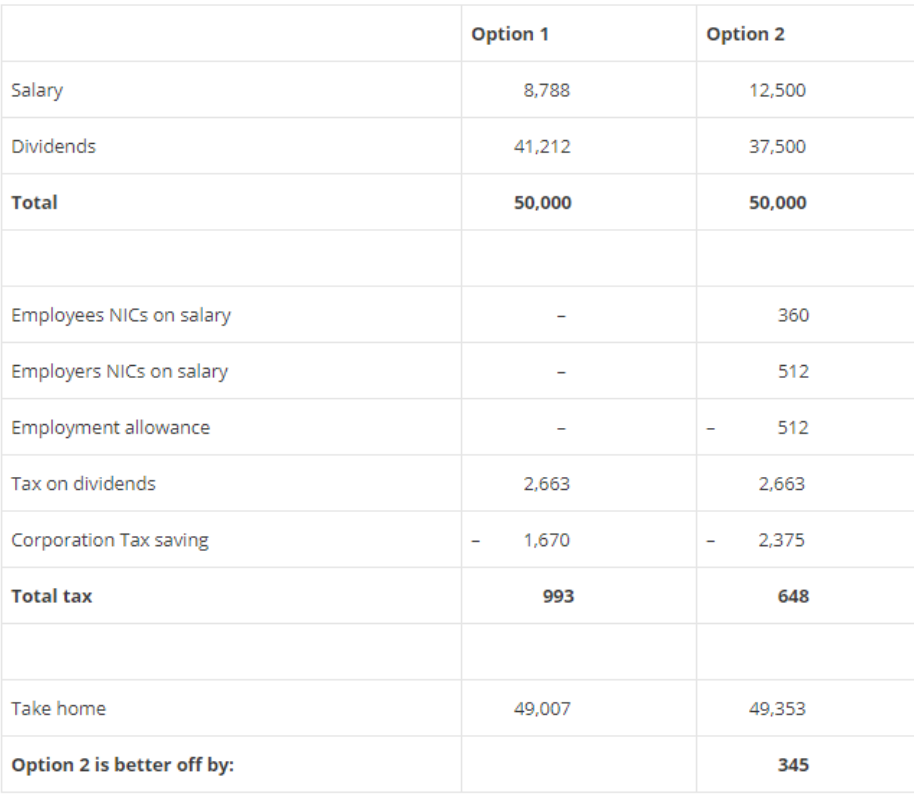

Therefore, we would suggest a monthly gross salary of £732 which stays just below this threshold and means no national insurance deductions. This way you pay yourself a salary of £8,788, you can then take dividends of up to £41,212. (Which is within the basic rate band of £50,000). These dividends will incur £2,663 of tax.

Overall, you will take home £47,337 after tax – with a saving of £1,670 in corporation tax.

Optimum Directors Salary 2020-21 – Option 2

If you can claim Employment Allowance, there is a little more administrative effort involved in this process, but you will still save money.

If you pay yourself a salary on £12,500, you will pay employers National Insurance – at £512.26. When taking £12,500 in salary, your Employment Allowance cancels out your employers National Insurance contribution. You will still have to pay employee’s National Insurance at the lower rate of £360. Leaving you with a corporation tax saving of £2,375 less the NI of £360 – hence overall you will be £345 better off compared to Option 1 above.

Comparing the two options:

If you’d like to know more about how you can maximise your earnings and take advantage of tax-efficient planning, do please get in touch today.