Upcoming Changes to Corporation Tax and Accounts Filing: What You Need to Know

Recent updates from both Companies House and HMRC, key changes have been announced that will affect how small businesses handle their corporation tax filings and annual accounts.

UK Small Businesses Brace for Rising Costs: Insights & Solutions

For many businesses, there is a looming pressure that is intensifying concerns over profitability, cash flow, and business continuity.

Important Update: New Companies House Rules - What They Mean for You and How We're Heping

If you’re a company director, business owner, or person with significant control (PSC), these changes will affect how information about your company is filed with Companies House.

HMRC penalties for late payment updated for 2025

Did you know that HMRC can charge you interest on your late tax payments? With that interest rate now set at 8.5%, it makes a lot of sense to pay your tax on time, every time.

HMRC is sending letters about MTD for ITSA

An official HMRC brown envelope regarding MTD for ITSA is on the way. We’ve got a full explanation of Making Tax Digital for Income Tax Self Assessment and what you need to do.

Year-End Checklist for Sole Traders & Landlords

This checklist will help you get organised for providing information to your accountant, preparing year-end accounts, and filing tax returns accurately and efficiently.

Form C79

The C79 form is the primary means for businesses to claim refunds on VAT incurred on eligible expenses.

MTD ITSA FQA: Everything You need to know

MTD ITSA is HMRC's digital tax system requiring self-employed individuals and landlords to maintain digital records and submit quarterly HMRC updates.

What Is MTD ITSA, and How Will it Affect Self-Employed Individuals?

Making Tax Digital for Income Tax Self Assessment (MTD ITSA) A major change in the way self-employed individuals and landlords in the UK manage and report their taxes.

Measuring the health of your business with ratio measures

Just as we prepare for the festive season with to-do lists and careful budgeting, measuring the health of your business ensures you're set up for a prosperous future.

A Festive Focus on Cash Flow Forecasting

As Christmas approaches, the season's magic often brings added demands for time, gift-giving, and celebrations.

Cash Flow and Cost Control

Regular cash flow forecasts help you keep your focus. Reining in your costs may give you a little extra headroom to manage cash flow while you plan your next move

Know your numbers - Your Balance Sheet

Your Balance Sheet tells you whether the value of your business is going up or down if the business is properly funded, and whether the working capital is healthy.

Adopting an Atomic Habits mindset

If you struggle to make habits stick, stop focusing on habit outcomes and consciously adapt your identity to be the person that aligns with your habit.

Your Business Plan: The Roadmap to Success

As the saying goes, 'Fail to plan, plan to fail.' If you're going to create an effective, successful, and profitable business, you need to create a solid strategic plan.

The Autumn Budget 2024: How it affects your small business

Here’s our small business summary of the Autumn Statement, with all the major tax, National Insurance and minimum wage changes explained for you.

Spreading your tax costs with Time To Pay

Have you been hit with an unexpectedly large tax bill? One way to manage this is to apply for a Time to Pay arrangement with HMRC. We’ve got the lowdown on how to do this.

Are you pursuing a trade or following a hobby?

Are you pursuing a hobby, or carrying out a trade? It can be hard to define in some circumstances, so we’ve explained the nine ‘badges of trade’ as used by HMRC.

What is Making Tax Digital for Income Tax Self Assessment?

Making Tax Digital for Income Tax (MTD for ITSA) comes into force from April 2026. We’ve got all the advice you need for getting ready for digital record-keeping and tax submissions.

The Top Five Accounting Mistakes to Avoid

Are you making any of these accounting mistakes? We’ve outlined the top 5 accounting issues that small business owners trip over so that you don’t have to make the same mistakes.

Charging interest on a Directors' Loan Account

Charging interest on your Directors' Loan Accounts (DLA) could be smart, helping you become more tax efficient. Dive into our DLA explainer and find out how to do it.

What should be on a VAT invoice?

Are you VAT-registered? Are you complying with the regulations when sending out VAT invoices and claiming against supplier invoices?

VAT on private school fees: What you need to know.

Did you know that private school fees will have VAT charged on them from 1 January 2025? We’ve outlined the key changes and how they may impact your spending on education.

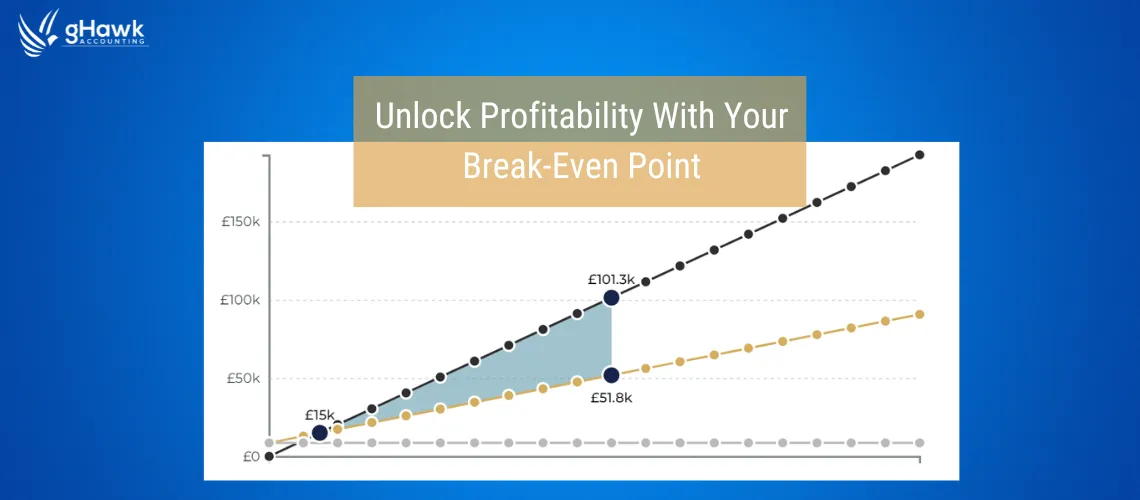

Small Business Break-Even Analysis for Tradespeople

The spring budget presents opportunities for small business owners, including cuts to National Insurance, VAT registration amounts

Spring Budget 2024: Key points for business owners

The spring budget presents opportunities for small business owners, including cuts to National Insurance, VAT registration amounts

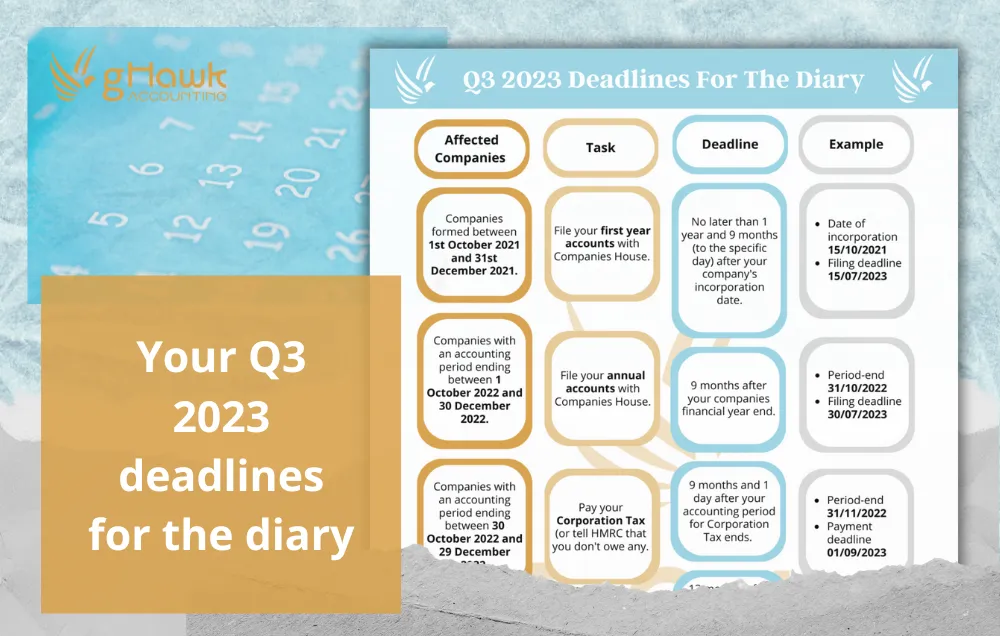

Your Q3 2023 deadlines for the diary

Here are the forthcoming deadlines and cut-off points for Q3 of 2023 to add to your diary.

Take care of yourself, not just your business

53% of business owners suffer from stress and anxiety. But it doesn’t have to be that way. We can help you talk through your worries and focus on your personal well-being.

When should I register my company for VAT?

Wondering if your business should be registered for VAT? We’ve got the lowdown on when (and how) to get VAT registered, and the key reasons for doing so.

Do you need to improve the cash flow position for your business?

Turning a profit is at the heart of running any successful company - But without cash flow, you can't run your day-to-day operations or grow the business.

What are the main changes to the research and development tax relief scheme?

Spring Budget 2023 brought in some significant changes to the Research and Development (R&D) tax relief scheme. Here’s our update on the big changes to be aware of.

HMRC Changes to VAT Online Account & Self Assessment Threshold Adjustment

HMRC has recently made significant changes to its VAT online account system, which affects VAT-registered businesses in the UK.

If you cannot pay your tax bill on time

Let’s face it, there are times when we want to do the right thing, like pay our tax bill on time, but we haven’t got the cash available.

Do you hate being asked for bank statements

Our company seeks new technology to improve efficiency and processes. If you're a business owner who prefers not to send bank statements, we have a solution.

Should I get an electric car?

Choosing an electric vehicle (EV) as a company car makes a lot of sense in 2022. We outline the eco and tax benefits of opting for an EV over an internal combustion engine vehicle (ICEV).

What are the risks of taking out a personal loan?

Do you know the risks of offering a personal guarantee on a business loan? We’ve outlined all the key risks to think about when entering into a loan agreement.

Taxpayers given more time for voluntary National Insurance Contributions

The UK government has extended the deadline for voluntary National Insurance contributions to 31 July 2023. Act soon to avoid missing out on this opportunity.

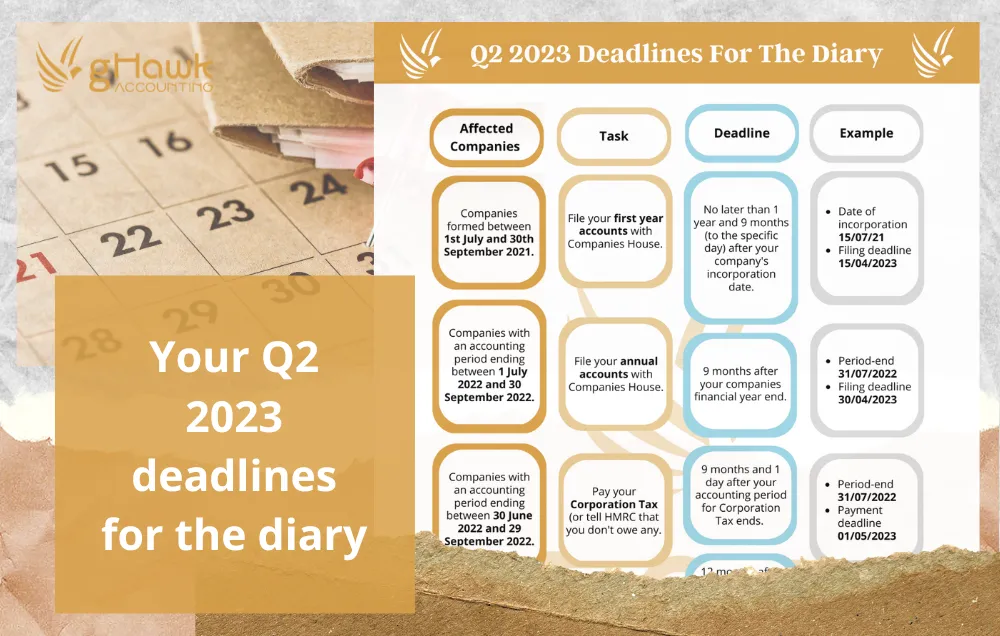

Your Q2 2023 deadlines for the diary

Get these Q2 2023 dates and deadlines in your diary – and make sure you don’t miss any important filing and tax cut-off dates.

5 Things a business owner must do at the end of the financial year

As the end of the financial year approaches, business owners should take some important steps to ensure a smooth transition into the new year.

Stressing about your work/life balance

Don’t stress about your work/life balance - a little stress can actually be good for you as long as you keep it within bounds. Talk to us.

Are you paying yourself to little?

Even if your business is about following your passion, you still need to pay yourself fairly, but that figure can be difficult to arrive at.

BIG Buzz Business Networking Event - April 20th

Have you heard the exciting news? Lenah Oduor, Director and founder of ghawk Accounting, will be speaking at Oxfordshire's 'BIG buzz' business networking event!

QuickBooks Connect London 2023

gHawk Accounting attended QuickBooks Connect London to connect with strategic partners in the accounting industry and pick up on best practice for small business owners.

What is Section 455 Tax?

Do you have advances that have been paid to you? Under certain circumstances, these could trigger Section 455 tax. We explain the main rules and considerations.

The benefits of splitting your property income

We’ve highlighted the tax benefits of a profit split and how we can help you overcome any capital gains issues.

Tax on gifts to employees and directors

Not sure about the tax implications of giving gifts to your employees? We’ll help you draw up internal guidance to make sure any gifts don’t unintentionally fall outside HMRC’s Trivial Benefits rules.

CASE STUDY: What would you do with £8,791?

Yes. If I gave you £8,791 today, what difference would that make? I ask that because that is how much we saved our clients by recommending an alternative way of doing things in their business.

Corporation Tax Rise from 19% to 25% from April 2023

From 1 April 2023, the rate of corporation tax will change from 19% to a variable rate between 19% to 25%, depending on the profits made by your business.

HMRC’s new penalty regime starts in January 2023

HM Revenue & Customs (HMRC) is about to update and change its penalty regime – and these new penalties could affect your tax submissions as early as January 2023.

ChatGPT For Your Small Business

Have you heard about ChatGPT? What is it? ChatGPT is the new software everyone is talking about. What is Chat GPT?

Keeping your cashflow strong in tough times

When sales are slow, there are still overheads and salaries that need to be sorted. Pre-planning and being proactive can help you weather tighter economic periods and allow you to continue to thrive.

How to increase profit, cashflow and business value

Do you regularly monitor your KPIs to ensure continuous improvement? Are you measuring the KPIs which have the greatest impact on your business? Have you set targets to improve them?

VAT Compliance Check: 7 ways to get away without penalties

You receive a letter from HM Revenue and Customs that they will be starting a VAT Compliance Check on your business. What do you do?

15 Great Reasons To Use Cloud Accounting Software

Using an industry-leading cloud accounting system like QuickBooks Online or Xero gives you instant access to the information you really need in real time.

Purchases you didn’t know were tax deductible

Many businesses find that they are missing out on potential tax relief due to expenses they didn’t know they could claim.

How to pay your Self-Assessment Income Tax

Taxes don’t have to be difficult or confusing. If you’re a freelancer or sole trader, it can be much easier to keep on top of your tax contributions than you might think.

7 Ways to avoid Construction Industry Scheme pitfalls

Under the scheme, contractors pass money from the subcontractors' payments to HMRC as an advance payment towards the subcontractor’s tax and National Insurance contributions.

Maintaining Customer Relationships

With new businesses constantly entering the scene and customer expectations evolving, building long-term relationships is one of the most effective—and cost-efficient—ways to grow your business.

Reinventing Your Product and/or Service For Long-Term Success

There often comes a time when your business needs to evolve. The most resilient companies are those that recognise change as an opportunity, not just a challenge.

Understanding Your Profit and Loss Statement

Your profit and loss statement (P&L) helps you understand your business performance and profitability over time. It’s sometimes called an income statement, which mainly lists income and expenditures.

5 Ways to Reduce Your Business Energy Bills

Rising global energy prices are a worry for all business owners. When the cost of your predicted annual bill doubles overnight, that’s likely to stretch your cash flow extremely thin.

Managing your business expenses automatically

automate the process of entering your bills, receipts and expenses by using AutoEntry. AutoEntry helps to save time by eliminating the manual entering of expenses.

Self-Assessment penalties to watch out for!

The deadline for filing a self-assessment tax return is 31 January. If you don’t submit your tax return, submit it late or submit incorrect information – you could face fines and penalties from HMRC.

The Importance of a Business Bank Account

When you start running a business, it’s important to be able to clearly separate your own personal money from the cash that’s been generated by the business.